Step-up your Underwriting with Alternative Data Analysis

Go beyond traditional credit data to get a more complete picture of a borrower's financial health!

Approve the Right Applicants!

How to make more informed decisions on new NO file and THIN file borrowers:

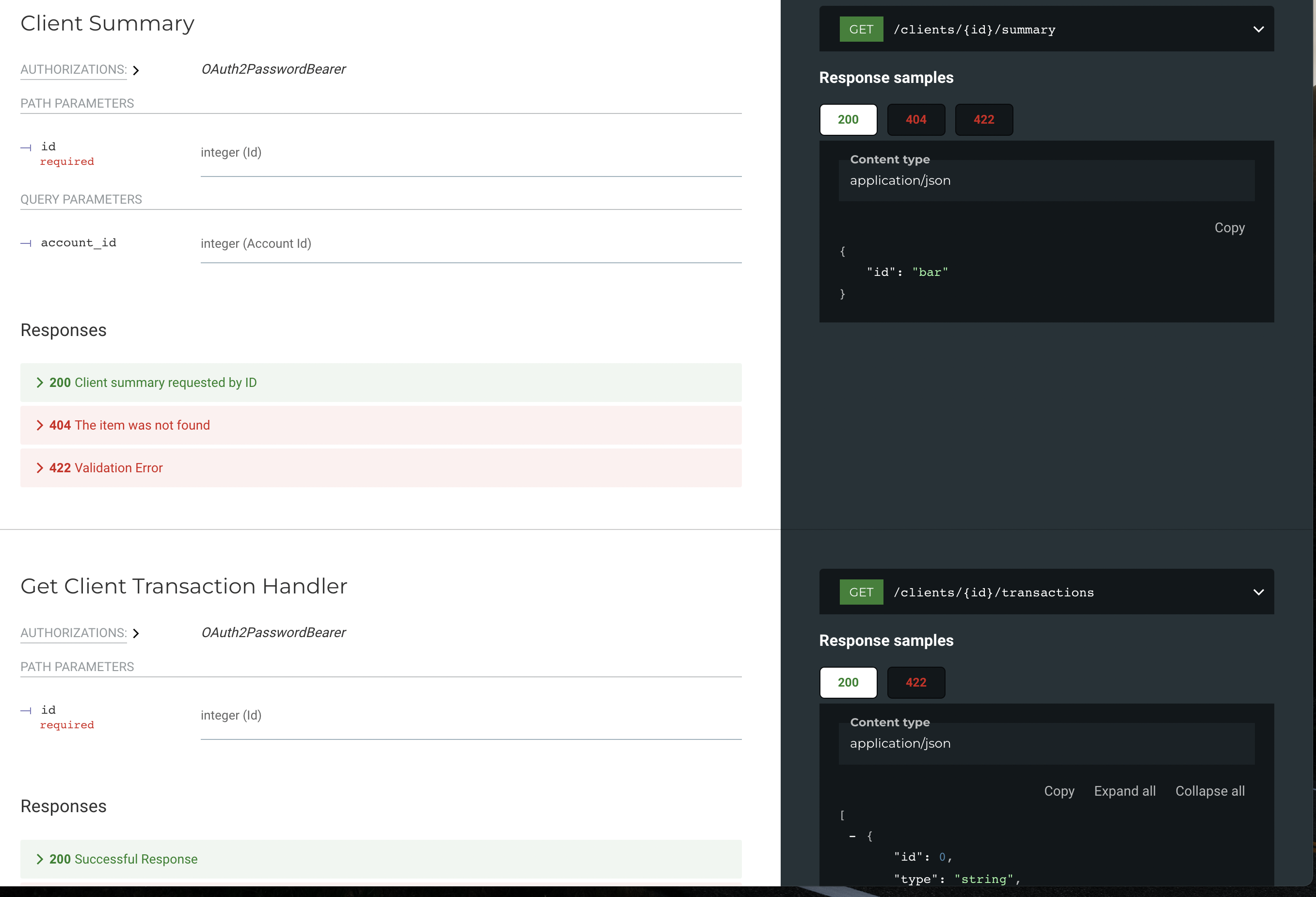

Upload your applicant's data on a web dashboard or via APIs.

Utilize machine learning technology to analyse clients' data.

Get a social profile and an income and spending patterns summary.

Make a credit decision from estimated loan ability and other scores.

Get started in minutes

Dashboard Access.

- Online dashboard

- Multi-User access

- Multi-device access

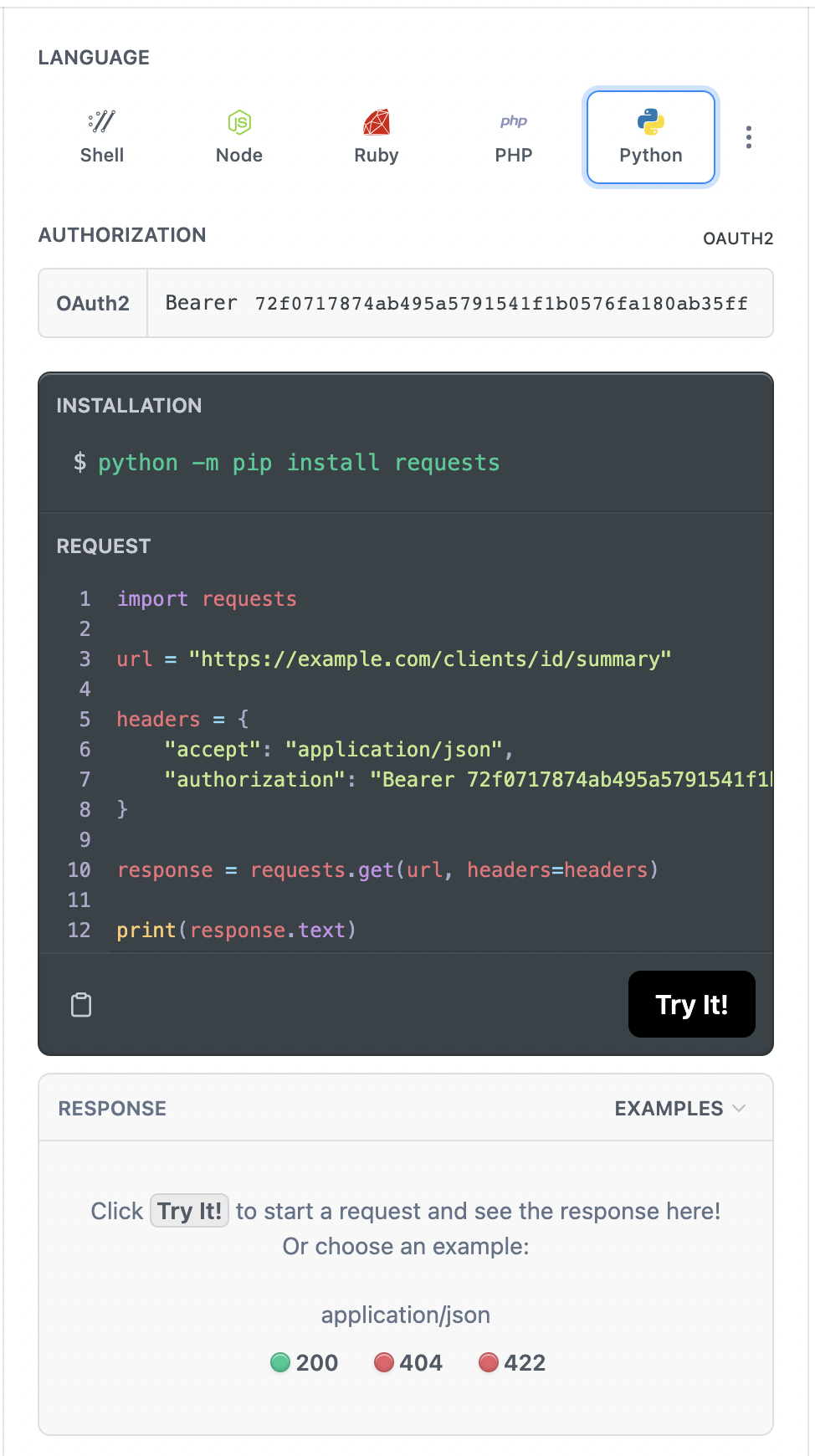

API Integration.

- Cladfy's API is REST based

- Data-exchange format is JSON.

- The API follows HTTP rules.

Credit Profiling & Loan estimation

Make more informed financial decisions with an added layer of insight.

Automate tasks and free up your teams to focus on more strategic work.

Validate and verify an applicant's stated income.

Assess risk for new clients & underserved segments using alternative data points.

Visit us

39 Riverside Drive,Nairobi.