Powering African Microfinance

Cladfy provides Microfinance Lenders with modern loan management software, alternative credit scoring solutions, and access to competitive loan-book financing sources.

Schedule a Demo Lender's Portal

End-to-end Loan Management

One platform for all your back-office processes.

Cladfy Origination.

Easy-to-use client onboarding tools for loan officers, and a self-service option for clients.

Cladfy Assessment.

Integrated proprietary & 3rd party credit scoring models to lend to the right borrowers faster.

Cladfy Core.

Powerful dashboard for your staff to visualize loans, deposits, expenses and other reports.

Cladfy Engagement.

Communicate with your clients via automated web notifications, 2-way Bulk SMS and emails.

Schedule a Demo See more

Alternative Credit Scoring

Mobile Money, Bank Statements, Repayments, Savings and Background data analysis for assessing a borrower's affordability and ability to pay.

1 Cashflow Score

A 3-digit Score and a Loan Ability estimate from the Analysis of Bank & Mobile-Money statements.

2 Demographic Score

A score from a Scorecard of weighted features(data-points) that considers an applicant's background data.

3 Deposits Score

A 2-digit score from the Analysis of a client's historical deposit/savings behavior.

4 Repayment Score

A 2-digit score that is computed from a borrower's past loan repayment patterns.

Explore the scores View API Docs

Affordable and Reliable Financing

Loan Book financing to on-lend from our partners.

On-demand working capital.

Draw-down liquidity only when your business needs it.

Flexible loan periods.

Repayment schedules that make sense for your business.

Competitive interest rates.

Affordable rates that allow you to maximise your spread.

Apply for Financing

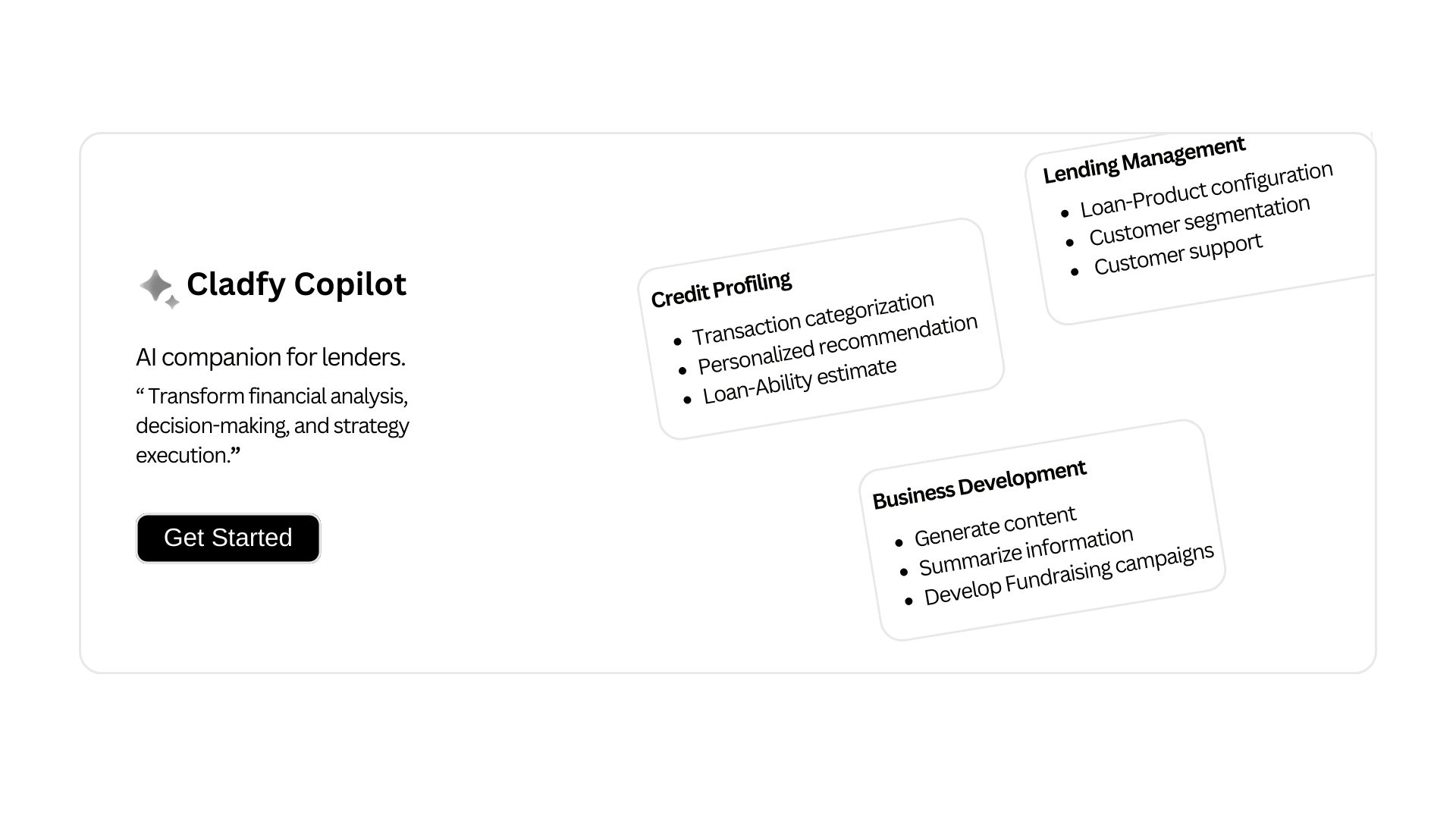

Insights on AI-powered lending

Equip your team to optimize loan processing and risk management.

Lend smarter with AI

Read More

Keep up with the latest news and insights.

Beat your competition with Cladfy

Simple, Secure and Smarter.

Tech infrastructure & tools designed to automate your processes.

Loan portfolio management.

Collections, without the pain.

Reconciliations, without the hustle.

Automated 2-way communication.

Unlimited performance reports.

Alternative Data analysis for credit assessment.

Insights from mobile money & bank statements analysis,

Demographic score from a borrower's background data,

A Deposits score from a client's deposits and davings,

A Repayment score from patterns in loan repayment,

And it is all consumer-permissioned.

Working Capital facility from our partners to fund your loanbook.

Revolving funds.

Fundraising, without the wait.

Flexible interest rates and repayment period.